Bear Market Signposts

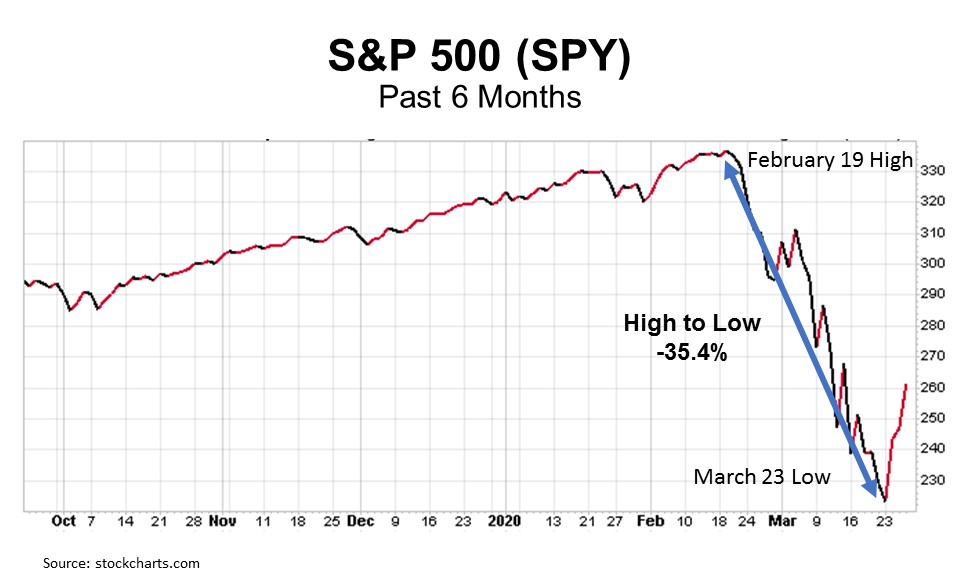

The mandated economic shutdown and corresponding collapse in asset values (stocks and bonds) as a result of COVID-19 seems unprecedented. In about a month, the economy transitioned from economic expansion to severe contraction and bear market. From the February 19 high in the S&P 500 to the low on March 23, the market was down 35.4%.

For the readers of this newsletter, our task is to navigate forward. No matter the speed or cause, financial markets provide investors with signposts as to where we are in the process of cycling down or up. Many of the signposts we are seeing are common to all bear markets and suggest that we may have experienced the bulk of the down move.

Signpost 1: The average decline in the S&P 500 during bear markets is 35%. If the current bear market does not evolve into a “structural” bear market (e.g., 2008), most of the damage to stock prices has most likely already happened.

Signpost 2: “Safe” assets were not safe

Ultra-short duration investment grade bond funds depreciated by about 5% in the past two weeks. High-yield municipal funds were down anywhere from 10%-20% in the same time frame. This is called the “dash for cash.” This is common in bear markets. Correlations migrate to 1 and almost all assets depreciate. With the recent actions of the Federal Reserve, safe assets are being restored to “safe.” The full restoration of liquidity in the bond market may take weeks but the process has started.

Signpost 3: Distressed and frozen credit markets are starting to recover.

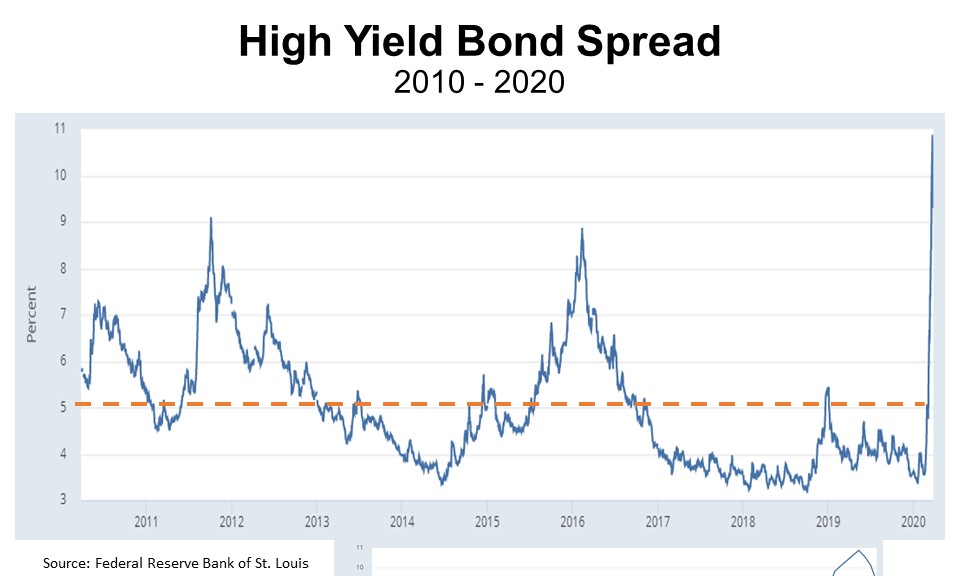

Risk measures in the bond market reached their second highest level (since the 2008 credit crisis) ever. One measure of risk is the spread between the risk-free (U.S. treasury) lending rate and the rate a less certain credit (i.e., corporation, municipality, mortgage borrower, etc.) must pay. In the graph below, we show the spread widening between treasuries and non-investment grade corporate debt over the past ten years.

This next chart shows the spread year-to-date and captures the small recent decline in spread.

During bullish stock market periods, the high yield spread is normally below 5%. This week, the spread reached roughly 11%. Given the full commitment of the Federal Reserve to maintain liquidity in the bond markets, spreads have begun to contract in the past day or so.

Signpost 4: The Delta MSI reached another all-time low this week

The Delta Market Sentiment Indicator is 1.6, down from 2.5 last week. Given recent positive stock market action (S&P 500 up roughly 17% from the low on Monday), it is highly likely the Delta MSI starts to move higher next week. Historically, after the Delta MSI moves below 10, stock market returns are normally double digit positive over the next twelve to eighteen months.

Signpost 5: Volatility appears to have peaked – but still high

The CBOE Volatility Index (VIX) has subsided from about 85 to 58 this week. Both from a sentiment standpoint and a technical aspect (less short selling of the S&P 500 by option market makers), having the VIX decline is an incremental positive.

A greater than 50 reading on the VIX is a very elevated reading. This is a signpost we are watching carefully and would like to see it drop below 50 before we become more confident the super-anxiety period is over. Stock prices are inversely correlated with investor anxiety.

If you are a buyer of the market today, you should expect to experience high volatility. This may be the price you pay for owning stocks at much better valuations than a month ago.

The current bear market is being driven by a health crisis. The health crisis may get materially worse or we may see unanticipated improvement. As a financial firm, we can only speculate on what might happen with the future path of the health crisis. What we can say is that the bear market signposts that are evident in all bear markets give us some degree of optimism on the margin. During times like this, position sizing and risk mitigation might be more important that attempting to perfectly time the bottom.

Give Us a Call Today

We have unique and sophisticated investment methods that seek to capture the stock market’s gains while minimizing drawdowns in bear markets. If you would like to learn more about how we manage money, we invite you to give us a call at (415) 249-6337, visit www.deltaim.com or email us at info@deltaim.com.