Whoomp! There It Is

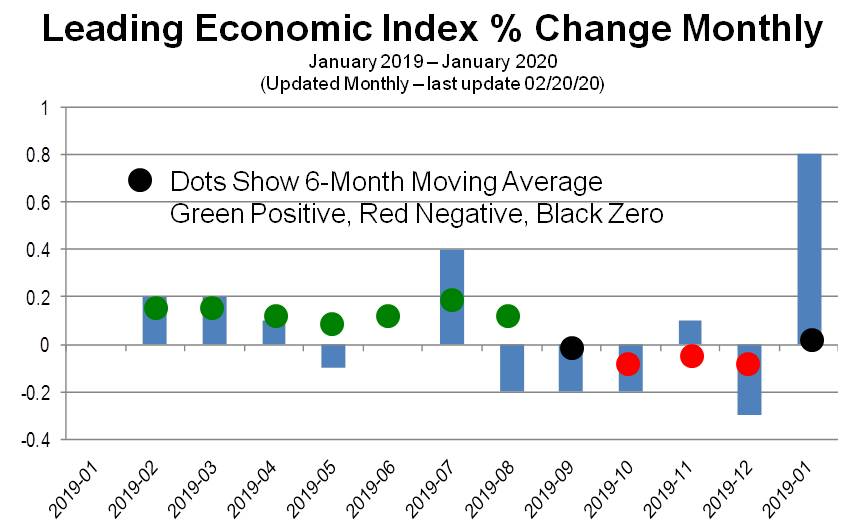

The Leading Economic Index (LEI) is an important indicator of recession risk. When the six-month moving average of the percent change month/month turns negative, recession risk is elevated. For the past three months, this has been the case.

The January LEI, reported this week, enjoyed a significant positive reversal. A strong pickup in the LEI driven by low initial unemployment insurance claims, rising housing permits, optimistic consumer sentiment and rising financial indicators raised the six-month LEI average from negative to zero. Zero is a positive.

The Delta Insights newsletters of January 24, January 31 and February 7 reviewed the weakness in the LEI and forecasted a rebound in the coming months. Two of the three primary causes of weakness in the indicator, China trade tariffs and UAW strike at GM, were relieved with the Phase One trade deal and the end of the GM strike in October of last year. The third pressure point, stoppage of Boeing 737 Max production, is expected to turnaround this summer.

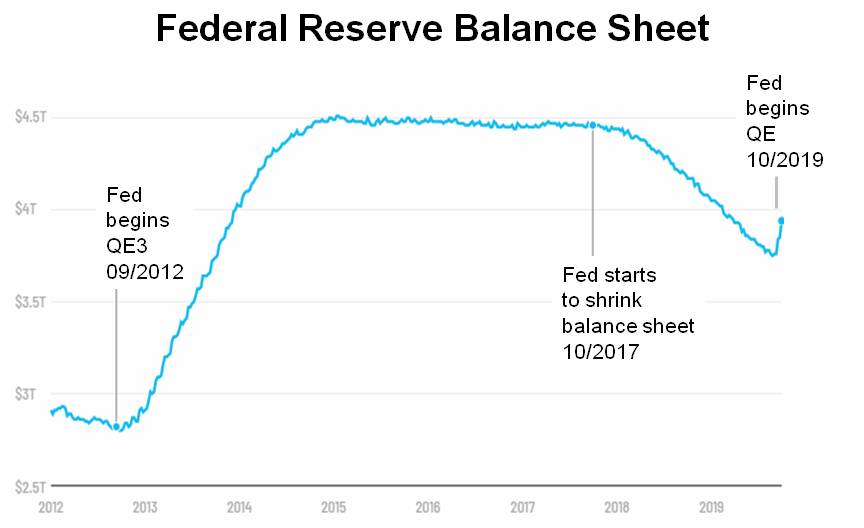

Interest rates are low and the Federal Reserve is buying $60 billion worth of bonds per month. The Fed’s quantitative easing program began last October, just when the six-month moving average of the LEI turned negative. This infusion of liquidity along with easing monetary policies of many of the world’s central banks is helping lift stock prices. Don’t fight the Fed.

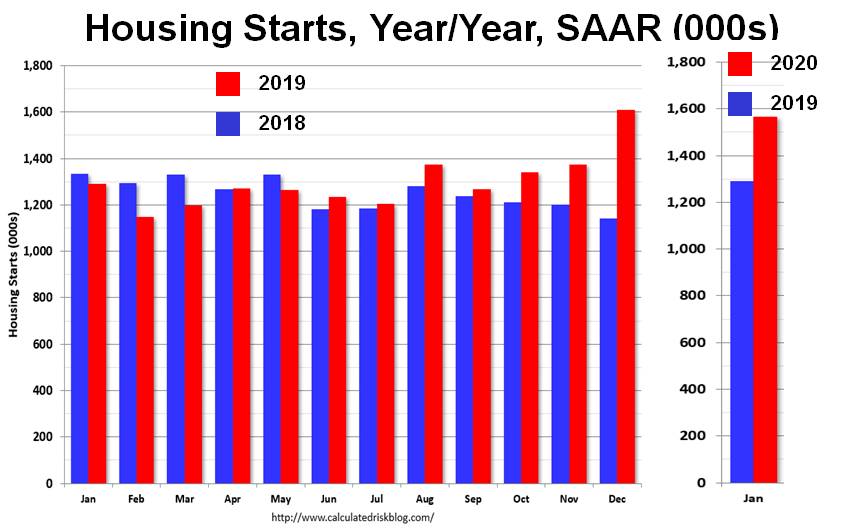

In the January 24 Delta Insights New Home Sales vs. Leading Economic Index, we highlighted the strength in housing starts. Below is the updated chart showing the strength has continued into 2020 with January starts up 21.4% year-over-year.

New home construction is a significant driver of GDP growth.

In bull markets, dips should be bought. In bear markets, peaks should be sold. The positive rebound in the LEI suggests this bull market has more room to run.

Give Us a Call Today

We have unique and sophisticated investment methods that seek to capture the stock market’s gains while minimizing drawdowns in bear markets. If you would like to learn more about how we manage money, we invite you to give us a call at (415) 249-6337, visit www.deltaim.com or email us at info@deltaim.com.