Extreme!

Most of the time market indicators are not at extreme levels. For example, the forward 12-month price/earnings ratio (P/E) of the S&P 500 is almost never below 10x or above 25x. The Delta Market Sentiment Index (MSI) is rarely less than 10% or greater than 90%. Investor confidence is normally somewhat balanced between bullish, bearish and neutral.

Occasionally indicators reach extremes. When this happens, market conditions are typically unbalanced and volatile. The significant positive of extreme indicator readings, however, is their robustness as predictive tools strengthens.

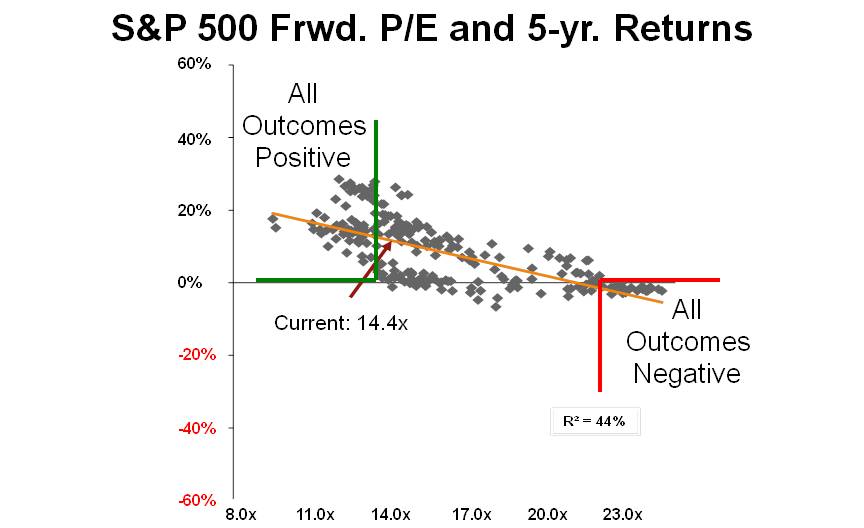

The chart below shows the S&P 500 5-year annualized returns at various P/E levels. The data is from 1993 through 2018. When the forward 12-month S&P 500 P/E has been below about 14x, the subsequent five-year annualized return has never been negative during the past 25 years. When the forward 12-month S&P 500 P/E has been greater than about 22x, the five-year annualized return has never been positive over the past 25 years.

In the last week of December, the forward P/E of the S&P 500 was 13.5x.

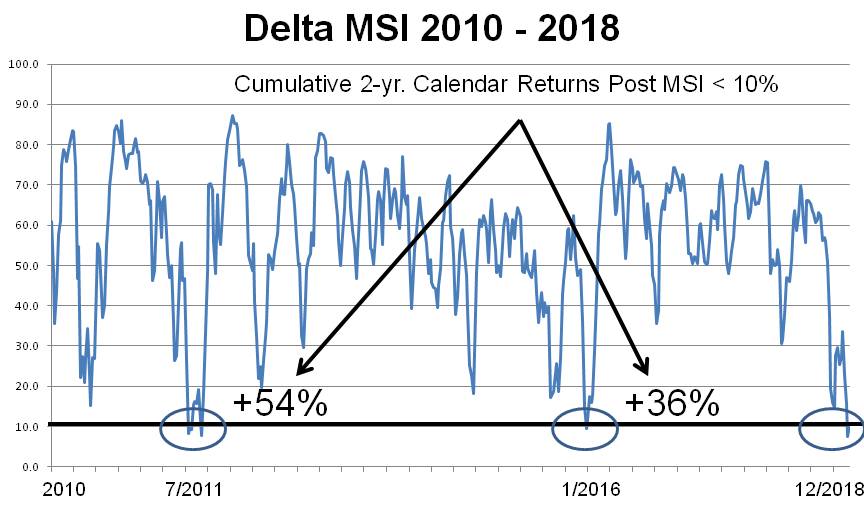

Since 2010, the Delta MSI has declined below 10% just three times: mid-2011, January 2016 and December 2018. Subsequent to the sub-10% readings in 2011 and 2016, the S&P 500 had two-year cumulative returns of 54% and 36%, respectively.

In Delta strategies that use the MSI as an asset allocation tool (Kress Tactical and Capital Appreciation), we often use a sub-10% reading as a buy signal. On December 27, the day the stock market reached its intra-day low, Delta’s MSI strategies bought equities. From the low through market close on Wednesday, the S&P 500 advanced by 10%.

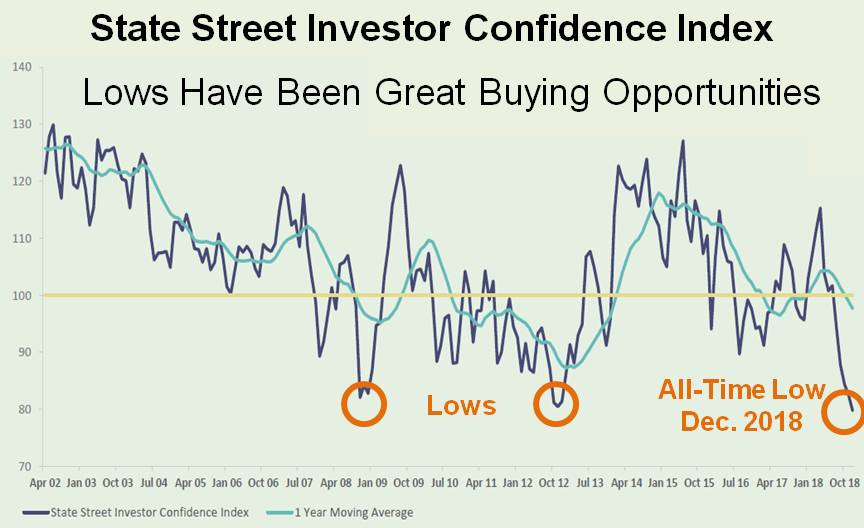

State Street Global Advisors is the world’s fifth largest asset manager with roughly $3 trillion in assets under management. State Street is the sponsor of many of the highest traded ETFs including SPY (SPDR S&P 500) and the industry sector SPDR ETFs. They monitor the actual buying and selling patterns of institutional investors and record this information as the “risk appetite or confidence” of institutional investors. They have recorded this information for the past 16 years as the “State Street Investor Confidence Index.” This indicator reached its lowest level ever in December 2018.

The two other notable lows in the State Street Investor Confidence Index were early 2009 and the end of 2012. The S&P 500 was up 23.5% in 2009 and 29.6% in 2013.

It is absolutely true that historical performance does not guarantee future returns. But, when investors begin to believe it is “different this time”, they are usually wrong.

Give Us a Call Today

We invite you to give us a call at (415) 249-6337, visit www.deltaim.com or email us at info@deltaim.com if you have questions about how we can assist you in managing your investment accounts.