Bullish or Bearish – The Delta MSI

Delta’s long-term market indicators which measure the probability of recession in the next six to twelve months are bullish – no recession. Specifically, the U.S. treasury yield curve (10y-2y) and the Leading Economic Index (LEI) remain positive.

The Delta Market Sentiment Indicator (MSI) published in Barron’s and shown at the end of this newsletter weekly is an intermediate-term market indicator. It evaluates the risk of investing in equities over the next several weeks to months. During the course of a typical year, it may transition from Bullish to Bearish and vice versa two or three times.

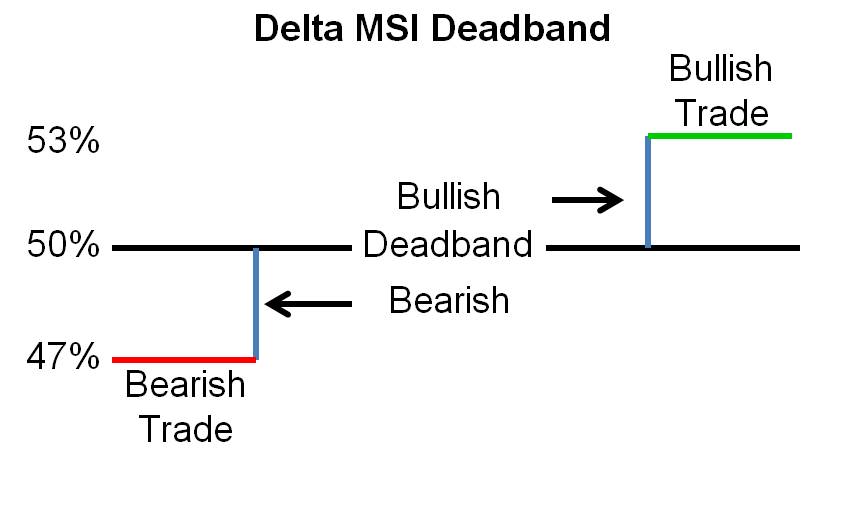

The MSI measures roughly 1,800 stock prices relative to a benchmark. The benchmark is the 75-day moving average of those stocks. When more than 50% of the 1,800 stocks are above the 75-day moving average, the MSI is Bullish. When fewer than 50% are above, the MSI is Bearish.

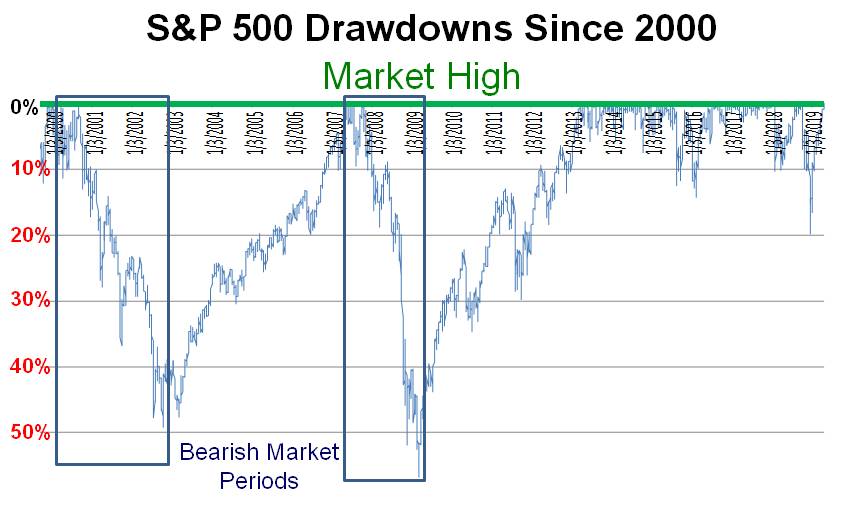

The weakness of almost any indicator determined by stock prices is whipsaw trading. Portfolios are usually not benefitted by overtrading the market. On the other hand, trading too infrequently can cause significant damage to portfolio values during bearish market periods which may take years to recover from. The Delta MSI seeks to find the optimum balance between taking prudent action to manage risk versus overtrading the market.

The MSI this week is 48.1%. This reading is below 50% and would seem to be Bearish. But, like a thermostat in your home, Delta maintains a 3% “deadband” area around the 50% level to reduce whipsaw trades (high frequency oscillation around the 50% level). In plain English, unless there are extenuating circumstances, Delta’s strategies that follow the MSI including Kress Tactical and Capital Appreciation have the discretion to remain invested until it is evident the MSI has broken materially below the 50% level (e.g., < 47%).

Patience is an investing virtue. So is being disciplined about following investment rules which have been effective over long periods of time through all kinds of market conditions. On an intermediate term basis, the stock market is potentially at an important juncture. On an intermediate term basis, we remain bullish this week but are on alert that the stock market risk profile may be going through a transition. Stay tuned.

Give Us a Call Today

We invite you to give us a call at (415) 249-6337, visit www.deltaim.com or email us at info@deltaim.com if you have questions about how we can assist you in managing your investment accounts.