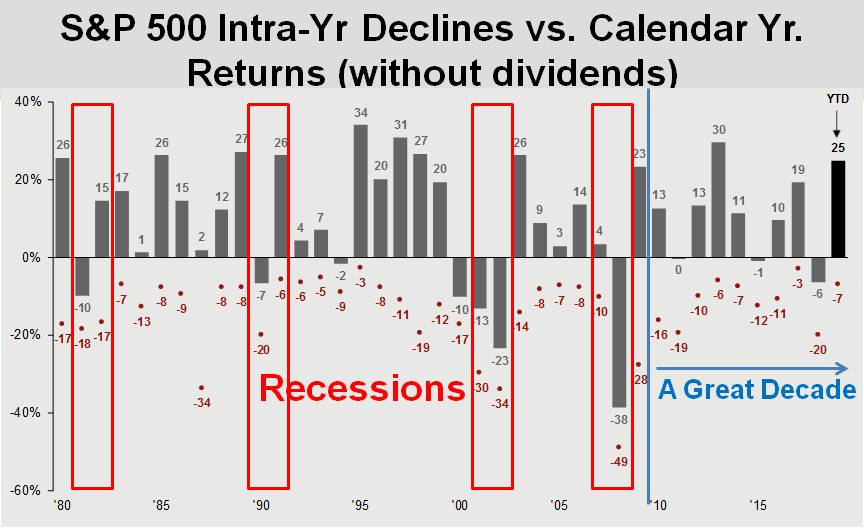

A Great Decade

The decade ending December 31, 2019 is the only decade in U.S. history without a recession.

The decade is a few weeks away from officially ending. If it were to end today, the average annual return of the S&P 500 during this decade is about 13.2% (including dividends). On December 31, 2009, the S&P 500 closed at 1,115.10. The S&P 500 this week touched new all-time intra-day highs at over 3,176.

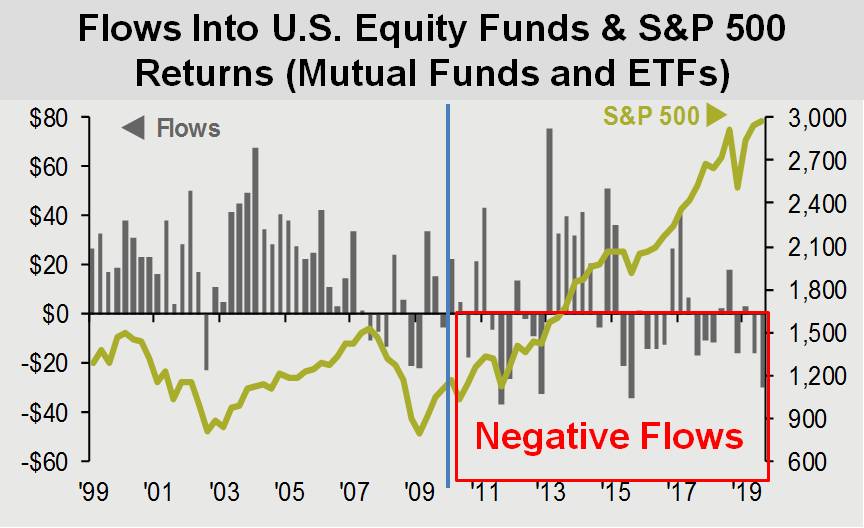

The shell shock of having the market lose about half of its value two times in the prior decade and trade at a lower valuation on December 31, 2009 than where it closed on December 31, 1999 made investors hesitant to put money into the market during the 2010-2020 decade.

The chart above shows much of the fund flows were out of stocks this decade. In the first decade of the 21st Century, the fund flows were mostly positive and the return of the market was negative.

After a decade without a recession, investors are still cautious. Markets climb walls of worry. Investor pessimism today is a bullish indicator. If we were to see increasing optimism and a move towards “irrational exuberance”, we would become more cautious.

Double digit returns are typical during bull market periods. This is true of the 1980 to 2000 (CAGR 17.9%) bull market and 1950 to 1968 (CAGR 14.7%) bull market.

Although it is estimated that about 1.6 billion people around the world will move out of poverty and into the middle class over the next ten years, the likelihood the United States enjoys two consecutive decades without a recession is low. The current U.S. expansion is the longest on record at 125 months.

The conclusions from the Great Decade are twofold:

- We are in a bullish period and investors should make every effort to capture the appreciation while it lasts.

- As time passes, the probability that we are faced with a recession and a bearish market is rising. Investors should have a plan for how they will protect their wealth during this bearish period.

Building wealth in bullish periods and protecting wealth in bearish periods is exactly what Delta Investment Management has been doing for years and can help you accomplish going forward. Give us a call.

Give Us a Call Today

We have unique and sophisticated investment methods that seek to capture the stock market’s gains while minimizing drawdowns in bear markets. If you would like to learn more about how we manage money, we invite you to give us a call at (415) 249-6337, visit www.deltaim.com or email us at info@deltaim.com.