Stocks Have Positive Momentum

Stocks just won’t seem to go down lately. Through Thursday of this week, there have been 12 S&P 500 record high closings month-to-date. The all-time record for S&P 500 record closing highs was set in June, 1955 at 16. On the four days the S&P 500 has traded down in 2018, the cumulative decline was less than 19 points (~0.7%).

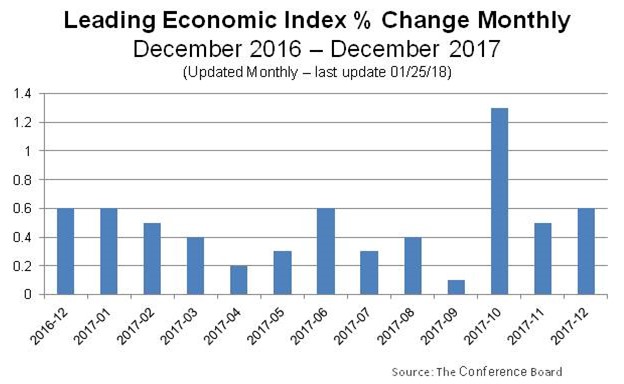

Part of the reason for the strong market is the economy is performing well and accelerating. The Leading Economic Index (LEI) came in at up 0.6% for December which makes 16 consecutive positive LEI monthly reports.

Earnings season is off to a strong start. So far through January 19, 11% of the S&P 500 companies have filed their fourth quarter 2017 reports. 85% have exceeded sales estimates by an average 0.9%. Overall sales growth is about 7%. The 5-year average of sales beats is 56% and the 1-year average is 64%.

Short Squeeze

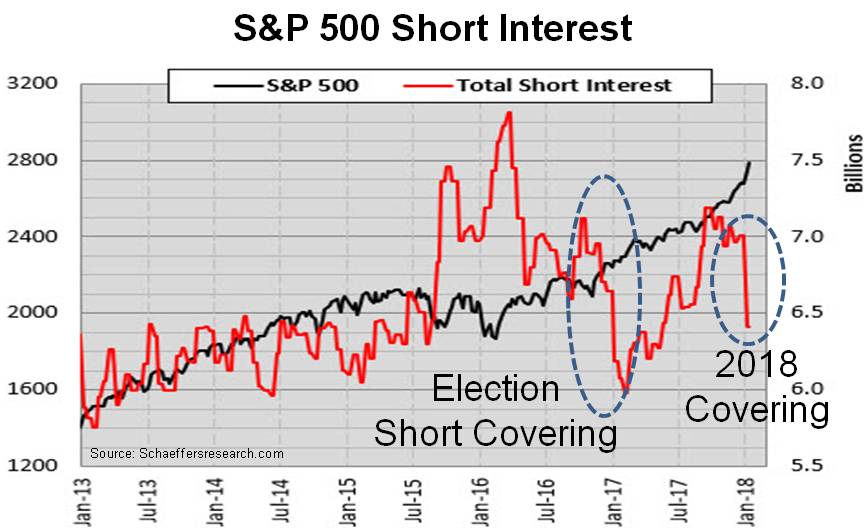

Stocks go up when there are more buyers than sellers. When stocks are borrowed and sold (sold short, a bet a stock or index will trade down), the investment loses value if the short-held stocks appreciate. Theoretically, there is no limit to how high stocks may appreciate. Short sellers, when squeezed by rising stock prices, often buy back the stocks they are short to cover and close out the losing trade.

The chart below shows that there has been a significant decline in total short interest (the blue oval 2018 Covering) over the past month. Short covering currently is another source of stock buying that is providing the market with positive momentum. The chart also shows short covering was a bullish driver of stocks following the election of President Trump.

Intra-day dips are bought by investors covering shorts. Short-covering ignores the news flow like government shutdown, etc. The rising market attracts a broader group of investors. A bullish virtual cycle is underway.

In the six previous cases when the S&P 500 had 12 or more record closing highs in a single month, the index had a positive return over the next three months five of the six times. The average return over the next three months in the five cases which had positive returns was 4.6%. In the one case the market declined over the next three months, the market was down -1.9%. Bull markets have momentum.

It is important that in markets that are rising partly as a result of non-fundamental drivers (i.e., short covering), that we closely monitor the connection between rising values and economic and company fundamentals. The forward twelve-month P/E on the S&P 500 has expanded from about 17.3x to 18.4x over the past six months. If earnings and inflation remain on their current trends, this amount of P/E expansion is not a cause of major concern. For now, we run with the bulls.

Printable PDF Version